Call Today! 888-234-8376

Cheapest Life Insurance

There are life insurance policies that will always be cheaper than others: If you are looking for the cheapest life insurance, a term life insurance policy is your best bet. Any type of permanent policy (whole, universal life, indexed universal life and any variable types of life insurance) requires costlier premiums since they accumulate a cash value and cover you for life.

A term policy is the simplest, cheapest form of life insurance. The rates for several cheap term life insurance policies below represent a 20-year term, which is a pretty standard length for a term policy.

Note: Before jumping into the companies offering the cheapest life insurance policies, it's worth noting that this list will change every so often. Companies will regularly lower their rates in order to attract more business.

Another note: Just because one company offers cheap term life insurance for a certain age and health doesn't mean that same company offers the cheapest life insurance for a different age and health. Each company has its own niches that it focuses on and a different underwriting process. Take this top 10 best cheap life insurance companies list as more of a general guide for cheap term life insurance.

Best Cheap Term Life Insurance Companies

Sample monthly quotes based on Clearlink partner, Principal.com, SBLI.com, NorthAmericanCompany.com and are for illustration purposes only. Actual quotes may vary. Rates based on healthy 40-year-old female for 20-year term life insurance. Data effective 12/5/19.

Call today: 888-234-8376

Choosing the Right Life Insurance Policy for You

To get the best insurance coverage for you and your beneficiaries, you'll want to consider the different types of life insurance options that are available to you as well as the individual needs you are looking to provide coverage for. As your situation changes you may also have different coverage needs over time.

Things you should consider when choosing the type of policy, coverage and duration of the coverage are:

- Income: If you want to use life insurance to supplement your income the general rule of thumb is coverage for 8 to 10 times the amount of your current salary. You may want to reevaluate this one as your income changes.

- Mortgage: Do you currently have a mortgage that would need to be protected?

- Debts: Do you have any other debts that would need to be covered?

- Children: Do you have children and want to have the assets for their education?

- Business: Are you a business owner looking to provide life insurance coverage on your business partner or looking to acquire an SBA loan?

- Retirement income: Are you looking to use life insurance to supplement your retirement income?

Final expenses: Are you looking to use life insurance to cover your final burial expenses?

How you can save money on life insurance

There are so many options for life insurance, how do you find the right policy for you? There are several ways that you can find the right policy for you and help keep some money in your pocket.

Research your options

Knowing the main options available can assist you in limiting your choices to the best type of policy that will cover your needs. Once you know the type of policy that is best suited for you, you should shop around to find the company that meets your needs and provides the most benefits at an affordable rate.

Most companies provide their rates online so you can compare the best life insurance rates.

Life insurance medical exam

While you may be more inclined to find a policy where you can skip the medical exam, you can save money by taking the time to take the exam if you are healthy. The younger and healthier you are when you decide to purchase life insurance the lower your rate will be.

Pay premiums annually

Most insurance companies will give you an option of how you want to pay your life insurance premiums. Typically they will also give you a discount if you pay them up front annually versus any other type of payment method.

Speak with an expert

If you have a complicated situation and aren't sure what the best policy or amount of coverage is best for you, you can speak with a licensed life insurance agent that will guide you to the best policy for your needs. Your best option is to speak with an independent licensed agent as they can provide options from many of the best life insurance companies instead of a captive agent, who is only able to provide policies and rates from one company.

Cost Is the Number One Reason People Avoid Getting Life Insurance

Life insurance can be a great way to provide financial security for yourself and your loved ones, but many people don’t have a policy. We decided to uncover who’s missing out on coverage and why. We’ve dropped our findings below—and busted a few life insurance myths along the way.

Using Pollfish, we surveyed 500 people living in the US age 18 and older. We asked eight questions about life insurance. The people we surveyed were from all different income levels, professions, and education levels.

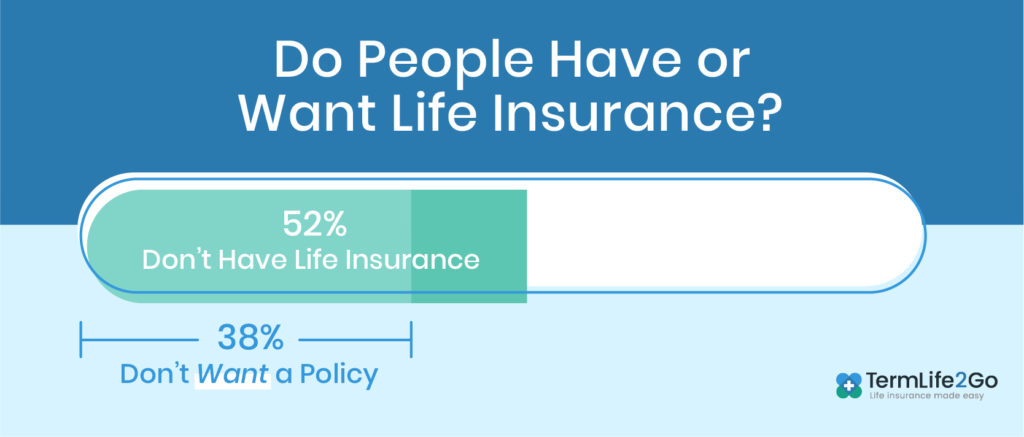

Of those, 38% said they don’t even want a policy. But should they buy a policy? That depends. Whether you need life insurance and the coverage level you need depend on a lot of factors. Here's our rule of thumb: if a loved one would be in a tight spot financially in the event of your death, you probably need life insurance.

The good news is…

Of the people who don’t already have a policy, 71% believe they can get life insurance. And that’s a good thing. But we think that percentage could be higher if more people learned about their options. For example, 21% of respondents believe their age disqualifies them from buying a policy, and 13% believe smokers are uninsurable.

The truth is, plenty of insurance companies specialize in covering older adults or tobacco users at reasonable prices. Other insurers have made a name for themselves by insuring people with preexisting conditions. Some even offer insurance that isn’t based on your health at all.

Long story short: Whatever your situation, there's probably an insurer out there that wants your business—if you decide to give it to them.

Three-quarters of respondents correctly identified that the younger you are when you buy a policy, the cheaper it will be. Well done, survey-takers! Age is the most critical factor in nearly all insurers' rates. Other factors include your gender, health, lifestyle, occupation, and whether you smoke.

Nearly all (81%) of people without life insurance said cost stops them from buying a policy. And, of the people who believe they can't get coverage at all, almost half (47%) chalk it up to cost. But the truth is, life insurance can be super affordable—under $10 per month for some applicants—if you buy term life.

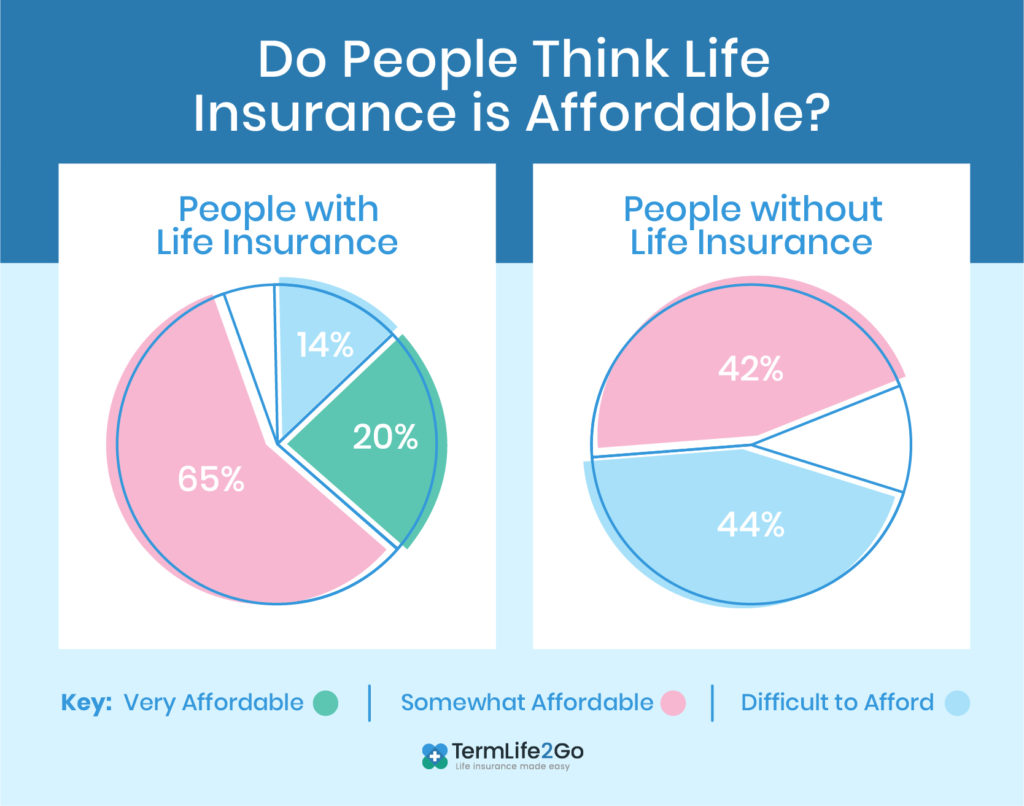

Of the people who have coverage, 20% say life insurance is “very affordable,” 65% say it’s “somewhat affordable,” and just 14% say it’s “difficult to afford.” Among those who don’t have life insurance, however, 44% say it’s “difficult to afford," and 42% say it’s “somewhat affordable.”

While it might seem that those who have coverage must be well-off, 61% of policy owners who think life insurance is affordable identified as lower or lower-middle class.

Not surprisingly, the number one factor shoppers consider when comparing companies is pricing, according to 79% of respondents. Unfortunately, many insurers don't offer online quotes. You may have to fill out several applications or use an online quote aggregator to compare rates among several companies.

Of course, price isn't the only factor consumers consider when shopping for life insurance—nearly half (49%) mull over what types of policies a company offers, for example. Most companies sell term life, but many have whole, universal, variable, and final expense insurance too.

Also important are customer service and reviews. Buyers consider these factors at 26% and 25%, respectively. Next comes the riders (add-ons) a company offers (7%), as well as a company’s commercials or other advertising (7%). Finally, some respondents mentioned they chose a policy because that’s what their employer offered as part of their benefits package.

Bottom line: there are a lot of cheap options out there, find the right one for you

Life insurance can be a complex financial product, but it seems that for many people, it may all come down to cost. Get quotes from several insurers or work with an agent who can point you toward low-cost, quality coverage that fits your needs.

Need more help finding the right life insurance policy?

- Learn more about the best life insurance for seniors.

- Learn more about the best final expense companies.

- See how you can prep for a life insurance medical exam.

- Learn more about saving money on life insurance.